Polestar Automotive Holding UK Plc investors sued billionaire Alec Gores and other architects of its blank-check merger, claiming they duped investors into a disastrous deal that gave insiders a windfall.

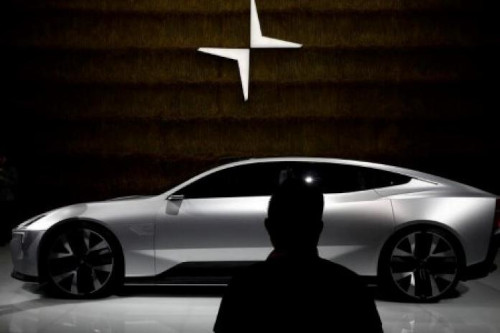

The lawsuit targets former backers of Gores Guggenheim, the SPAC that combined with Polestar affiliates to take the electric vehicle business public in June 2022. Polestar was previously a subsidiary of Volvo Car AB, the Swedish automaker owned by China’s Zhejiang Geely Holding Group.

The proposed class action echoes dozens of other cases in Delaware’s Chancery Court, the country’s premier venue for M&A fights, Bloomberg reports.

Polestar raised approximately $890 million gross proceeds on the deal through a combination of a fully committed PIPE and the SPAC’s cash in trust.

Share redemptions ahead of the vote amounted to about 20% of the outstanding stock.

Polestar shares opened at $12.98 in the EV maker’s Nasdaq debut more than a year ago. As of mid-afternoon today, the stock was trading at $3.74. Read more.